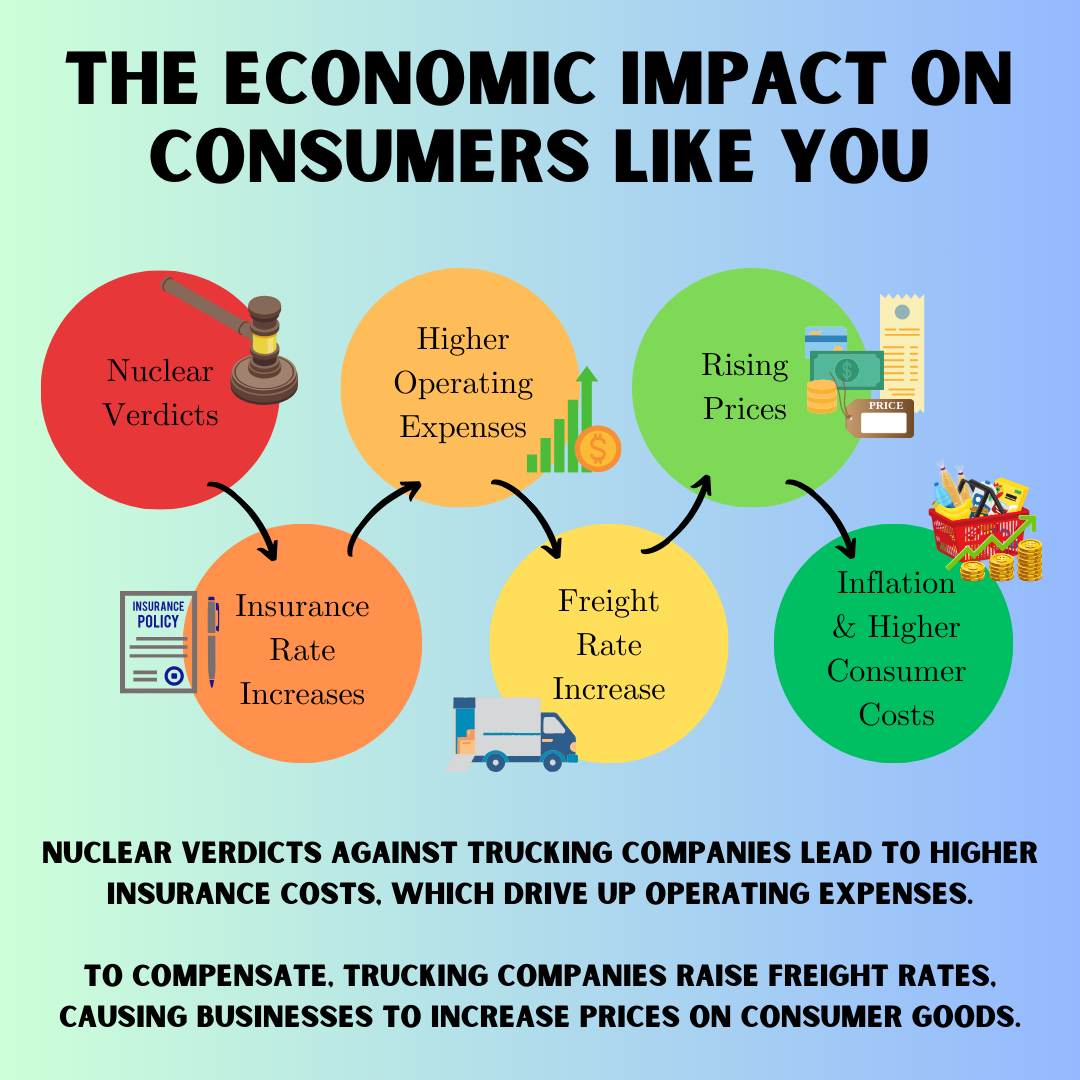

Nuclear verdicts against trucking companies and inflated awards pressed by injury lawyers lead to inflation and higher consumer costs through a chain of interconnected economic factors. Insurance fraud also raises everyone’s cost of insurance.

So, what can you do about it?

- Rising Insurance Costs: When trucking companies face large verdicts in liability cases, their insurance providers often increase premiums to cover the higher potential costs.

- Operating Expenses: Trucking companies, like any business, aim to maintain profitability. When their insurance costs rise significantly, they are compelled to adjust their budgets, resulting in increased operating expenses.

- Freight Rates: To offset the rising operational expenses, trucking companies may raise their freight rates, which means businesses relying on trucking services to transport goods will face higher shipping costs.

Social Inflation Costs Impacts:

- Consumer Goods: As freight rates increase, manufacturers and distributors pass on these additional expenses in the form of higher prices for consumer goods. This results in inflation, as the prices of a wide range of products and services rise.

- Supply Chain Impact: As shipping costs increase, businesses may opt to reduce the volume of goods they transport, which can disrupt the flow of goods and potentially lead to shortages or delays.

- Consumer Impact: Ultimately, the end consumer bears the brunt of these cost increases. They see higher prices for everyday items, from groceries to electronics, which can strain their budgets and reduce their purchasing power.

- Bankruptcy or Job Loss: If a company can’t pass these “lawsuit taxes” on to their customers, they will have to shut their business down. That “hauler” could be replaced by a larger out-of-state company – lost jobs and tax revenue!

- Higher auto insurance premiums for all

The Palmetto State’s Payout “System” for Auto-Accidents is in Dire Need of Reform

We are all paying higher costs for abuses of the “lawsuit system”

Auto insurance in South Carolina, and South Carolina’s 24,000~ separate commercial truck registrants face a “crisis of inflated demands” by lawsuit marketers and “Big Law.”

This also creates a “crisis of trust” in our civil justice system.

65% of commercial truck owners operate only 1 truck. That means they are owner-operators or just a small business with a single unit for their own commercial purposes. 95% of “fleets” operate fewer than 10 trucks.

Do you think truck owners have unlimited insurance coverage/cost options? No! No more than normal consumers.

Small, SC-owned fleets are dropping like flies. It is very difficult to try to collect useful data on the impact “insurance” (or lawsuits for that matter) is having on the churning, here-today-gone-tomorrow segment of small-business trucking.

We have little ability to credibly account for how many small businesses with trucks have gone under due to lawsuit abuse and insurance issues.

Insuring a venture as risky and volatile as “trucking” has simply become too unpredictable. The specter of nuclear verdicts handed down by inflamed juries in “Judicial Hellholes” is not attractive to risk managers. Hampton County is not the only such venue – maybe only the tip of the iceberg. South Carolina’s outlier “lawsuit system” is rife with abuse. Mistakes are being “monetized” – at all of our expense.

“Auto-related” fraud leads all insurance-related fraudulent complaints to the state’s agencies. Whether it’s ambulance chasers, predatory towing practices, staged accidents by organized criminal networks, or cheaters looking to “milk the system,” we are all paying for it.

This “crisis” is exacerbated by increasingly inflated medical claims and settlement demands. It’s also driven by the threat of punitive damages in every accident where a driver may be only a minor-offender or minor-at-fault party. Injury lawyers manipulate “the system” (of laws and court procedures) such that minor infractions can be turned to the legal-equivalent of “recklessness.” This is because all of these teams are indistinguishable. Lawsuit marketers and Big Law feed this frenzy and opportunism. This abuse must stop.

Willful, wanton, gross negligence – even “intentional”.

The harm from accidents can be devastating. That’s why activity should be insured, and we have a tort and civil “justice” system. But as is implied in the pervasive lawsuit marketing we are all witness to, too many auto-related claims have become a money-ball game.

That game goes like this:

- First, if you are involved in an accident with someone with no insurance, or minimum limits, lawyers might tell you go away. “That’s life, it’s not fair, I can’t (won’t) help you. Good luck” is most likely what you’ll hear.

- If there is money somewhere, lawyers working for a claimant sees that the client (and anyone else “impacted”) seeks every diagnosis and medical (mental) treatment imaginable;

- Lawyers search for any party that might have insurance or earned assets that might be available;

- They sort through where and how much insurance there is;

- They settle-out or dismiss those with no or small insurance policies – causing their “fault-%” to be shifted back into the pool to be re-distributed;

- This provision of law shifts that fault to anyone left in the lawsuit;

- At the end of that part of the game, the party with the most insurance sees he is likely to be forced be responsible for the fault of all of the others – or, until the claimant’s lawyer gets what they want or exhaust it all;

- If the “deep-pocket” defendant stands-up and demands a jury trial, the risk of paying a judgement at whatever amount a jury and jury approves is pervasive;

- At that point, the lawyer gains further leverage, threatening he can sway the jury to add-on punitive damages;

- The defendant plays the game and settles – or he rolls the dice and goes for the jury trial.

- The lawyer gets 1/3-40% of the recovery – plus “expenses.” (This is the perverse incentive to go for all they can get, unbridled by the legislature…hence the TV commercials and marketing.)

That’s why insurance companies are folding and settling. They know math.

That’s why vehicle owners get frustrated with “insurance companies” – when it’s not their “fault.”

Insurers, who ultimately pay these “awards,” aren’t much on gambling. Eventually, they must chalk up the loss against the insured, pass on these escalating “lost costs” to all insureds, across all lines of coverage. And we all pay one way or another.

This is termed “Social Inflation.” It’s real.

Make a Difference

Join us in advocating for tort reform and equity in the legal system. Together, we can drive meaningful change.